How To Register A Llc Business In Ct

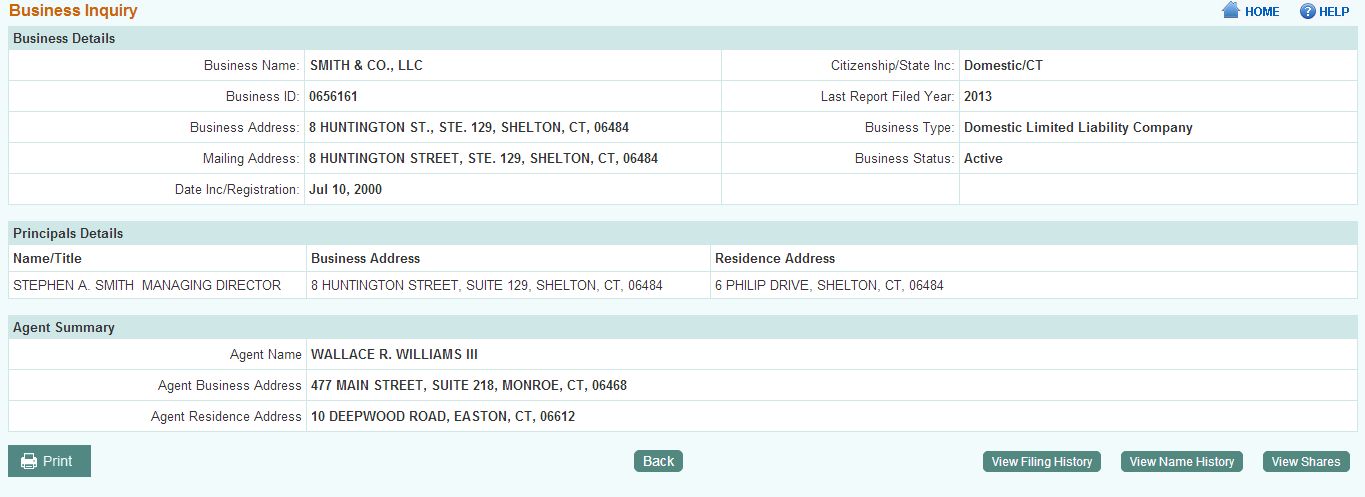

The name and address of all managers or members of the llc there must be at least one such as yourself.

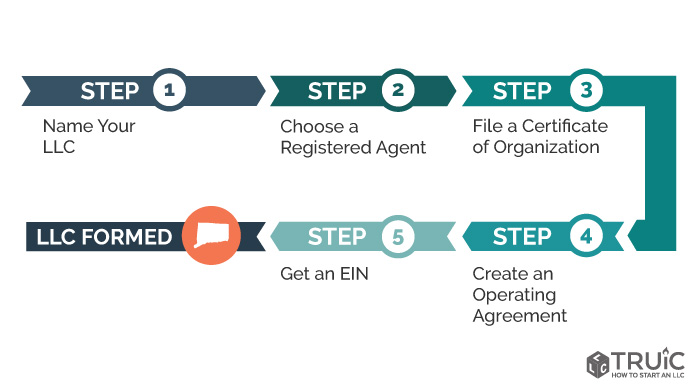

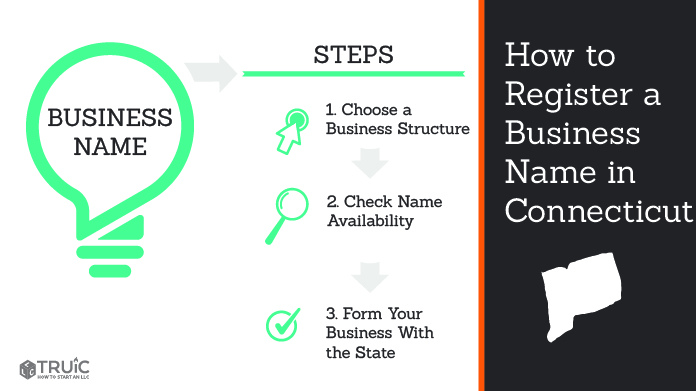

How to register a llc business in ct. You may apply in person at any of our field offices. A brief description of the nature of the business. You will receive your registration package with your permanent connecticut tax registration number in approximately 10 15 business days. You can still operate the connecticut llc without being a resident of connecticut however if you re doing business in virginia you should either 1 register your connecticut llc as a foreign llc in virginia keeps ein and bank account 2 dissolve connecticut llc and form a virginia llc needs new and new bank account or 3 merge. If you do not have a connecticut tax registration number or need to register additional locations register your business online.

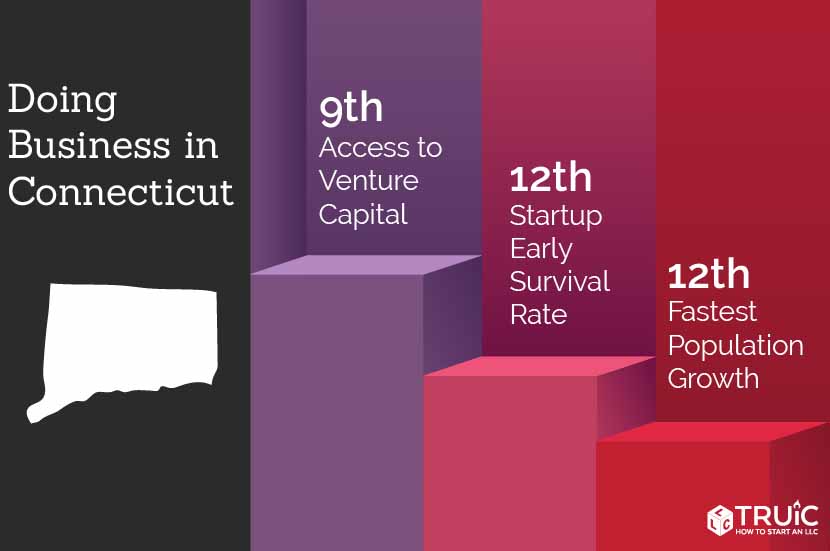

Contact the connecticut business hotline at the connecticut economic resource center by calling 800 392 2122. Because you are operating a business in connecticut you will need to register with the department of revenue and get a ct state tax identification number. You can register with the department of revenue using form reg 1 instructions or register online. If you apply in person during business hours you will receive a confirmation of registration immediately. You can apply online by mail or in person.

A connecticut registered agent is a person or company who agrees to accept legal mail on behalf of your llc in case your business gets sued. Register a new business online. In most states a registered agent will also serve as a general point of contact for receiving business and tax notices payment reminders and other documents. Identify all your licensing and registration requirements to start your business. And an indication of whether the llc will be run by manager s or its member s.

How to register your connecticut business license when opening a connecticut business the first thing you need to do is register your entity through the department of revenue and apply for a connecticut state tax id number. You will need to use form reg 1 if you make the application via mail or apply online. The name address and signature of the registered agent for the llc see the step below for more information on this. Only the connecticut department of revenue services can issue connecticut tax registration numbers for sales tax withholding tax and all other state taxes we administer. Federal employer identification number fein if applicable this is issued by the internal revenue service irs find out if you need one.

The form requires you to enter the llc s chosen name and business address which can be your home address. Visit our registration application forms page for applications and addendums which cannot be filed online using form reg 1.