How To Register Your Bank Account With Irs

The registration process is a one time automated process where the user selects a username password and pin that will be needed to log onto e services.

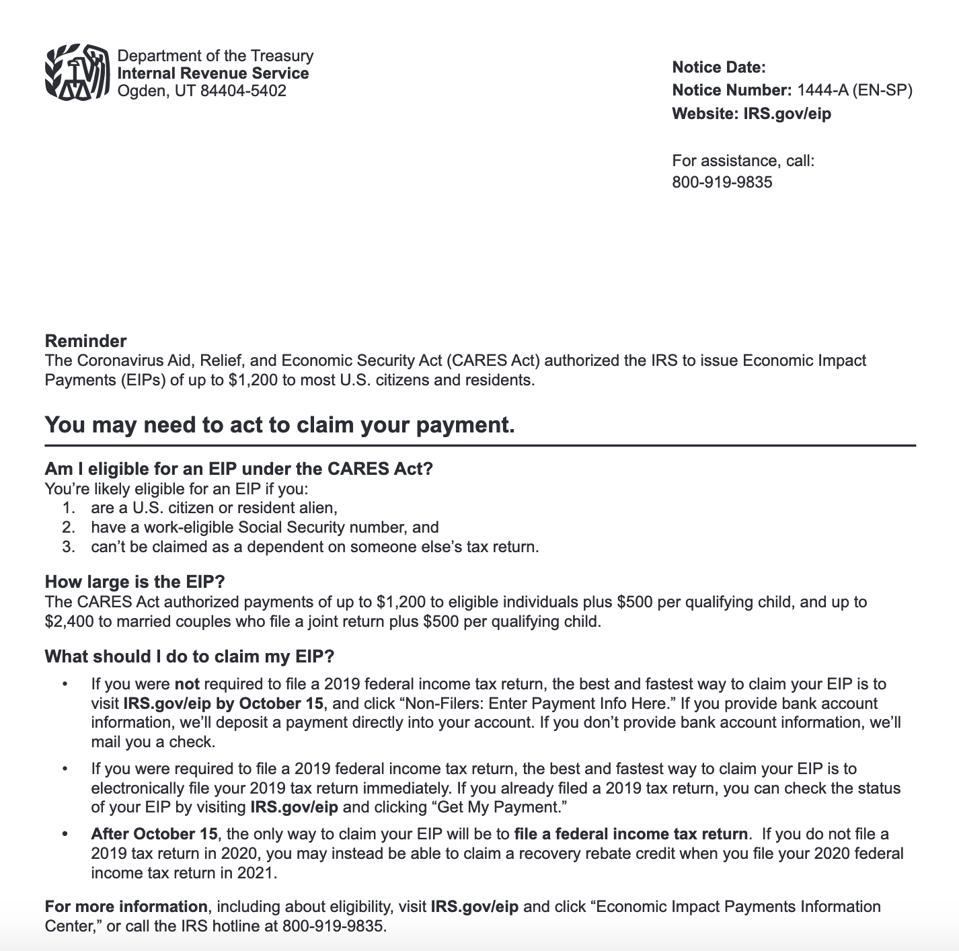

How to register your bank account with irs. The key is for the irs to have the direct deposit account information for your bank account. For those of you that need to provide the irs with information regarding your stimulus check the irs now has two portals available for you. The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. You can use it to deposit your refund into one two or even three accounts. Otherwise the payment will be sent by mail and could be delayed for several months.

You may need to file your 2019 and 2018 tax returns to complete the process. Entering bank or financial account information will allow the irs to deposit your payment directly in your account. It s a bit complicated and really scary. On an installment agreement and pay on time 500 mo. It can be started before during or after the ives application is submitted but.

An irs online services account lets you access most tax tools with the same username and password. As of april 15 the irs has a dedicated web portal called get my payment that you can use to set up electronic transfer of your financial relief check by covid 19 to your bank account if you have not set up direct deposit with the irs. If you can t register online search tools to find out if an offline option is available for the task you want to complete. The irs will use this information to confirm eligibility and calculate and send an economic impact payment. Otherwise your payment will be mailed to you.

The irs program is called direct deposit. Entering bank or financial account information will allow the irs to deposit your payment directly into your account. Otherwise your payment will be mailed to you as a paper check that will slow. Entering bank or financial account information will allow the irs to deposit your payment directly into your account. 1 855 tax fixx 855 829 3499 or text 248 522 1509 home.

Back taxes of 26k. The principal responsible official and each employee assigned to use e services products must register individually to create and have access to a secure mailbox. Now more than ever you need a reliable fast secure contact less way to receive your money. Using the tool to get your payment will not result in any taxes being owed.